This morning, WBD’s board of directors shared that they “unanimously” agreed that Paramount’s offer was “not in the best interests of WBD.” In a letter to shareholders, the board writes, “PSKY has consistently misled WBD shareholders that its proposed transaction has a ‘full backstop’ from the Ellison family. It does not, and never has.” The letter also addresses several of the other points that Paramount and the Ellisons had put forward, such as the argument that the company’s previous kowtowing to President Trump’s administration would make its offer the easiest to get regulatory approval. “Despite PSKY’s media statements to the contrary, the Board does not believe there is a material difference in regulatory risk between the PSKY offer and the Netflix merger,” the letter continues before pointing out that backing out of the existing agreement with Netflix would add additional costs: “WBD would have to pay Netflix a $2.8 billion termination fee, which PSKY has not offered to reimburse. In addition, WBD would incur approximately $1.5 billion in financing costs if we do not complete our planned debt exchange as agreed to…”

But, believe it or not, Paramount is undeterred. Having struck out with the board, the company issued a new press release today urging “WBD shareholders to send a clear message to WBD that they prefer Paramount’s superior offer by tendering their shares.” The company is sticking to its $30-per-share figure. In the press release, the company makes the rather strange assertion that its purchase of WBD would “enhance competition in the creative industries” as opposed to Netflix’s purchase, which would “entrench a dominant streaming monopoly.” In turn, Paramount accuses WBD of misleading its shareholders, that the merger is not a question of “complicated legal documents” but whether 30 is a bigger number than 23.

WBD shareholders must meet and approve the Netflix deal if it is to move forward, per Variety; it’s not immediately clear when we could expect that to happen. Paramount calls on the shareholders to tender their shares for Paramount “today.” For this to work, Paramount would need 90% of the outstanding WBD common stock.

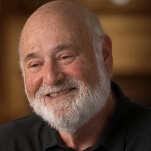

![Rob Reiner's son booked for murder amid homicide investigation [Updated]](https://img.pastemagazine.com/wp-content/avuploads/2025/12/15131025/MixCollage-15-Dec-2025-01-10-PM-9121.jpg)